While it was recognised that poverty eradication and growth were interdependent, in practice balancing them posed choices whose difficulties were magnified by the inherited macroeconomic crisis. The point of departure for implementing the democratic mandate was that short of dependence on international loans – which would have meant loss of policy sovereignty – it was necessary to get the economy on a sustainable path that promoted growth and attracted investment, domestic and foreign, and to impose a reorientation of the state by reallocating existing resources.514 This included the need to reduce volatility of the exchange rate. Mandela put it succinctly.

The president of the IMF came here and said, ‘The reason why your currency is unstable is because your foreign reserves are very low. I am prepared to help you, to give you funds.’ And I say, ‘No the difficulty with you is that you impose conditions which violate the sovereignty of a country.’ He says, ‘No I will not do so.’ I was happy and I then called Deputy President Thabo Mbeki and I said, ‘Man, this is what the IMF says.’ He said, ‘Nothing doing.’ I won’t go into the reasons which they advanced but I regarded them as better than me in questions of this nature and I accepted their suggestion that we don’t want to be indebted to anybody. We want to rely on our own resources and taxation and so on.515

our people are very careful

The preamble to the RDP White Paper stated that the Government was ‘fully committed to macro-economic policies which promote the RDP as an integrated and coherent growth and development strategy,’ which meant: gradually reducing the fiscal deficit, to avoid a debt trap, avoiding any real increase in recurrent government expenditure and reducing government dissaving over time. Government spending would be shifted towards more capital expenditure and the RDP financed mainly through restructuring of budgets towards RDP priorities. The civil service would be re-organised and trained for effective and efficient services to all citizens. Development of human resources; labour market reform and collective bargaining rights for all wrapped up the list of measures which were ‘essential if we are to succeed in attaining the objectives contained in the RDP.’516

The dependence of RDP objectives on an austere economic stance bore the imprint of the ANC’s progressively more worrying discoveries of just how deep the economic crisis was. During the pre-election negotiations Derek Keys, the National Party government’s finance minister, had briefed Trevor Manuel, then head of the ANC’s department of economic policy. Manuel conveyed what he had learnt to Mandela who concluded that extended negotiations would end with a democratic government inheriting an economy beyond recovery.517 Years later, while campaigning for the 1999 election, Mandela responded to a question about unemployment with an explanation of the state of the economy inherited in 1994.

I would like to place the question of unemployment in context because it would be a mistake to think that the question of joblessness has just dropped from the skies, that there is no history. In the decade leading up to April 1994, R51,1 billion left the country as a result of political uncertainty. Secondly, the economic growth rate was negative. And there was high inflation which was in two digits; also the budget deficit was in two digits.

But what was even more shattering was the discovery when we took over that this country had a public debt of no less than R254-billion which we are now paying at the rate of R50 billion a year. That is R50 billion which we do not have in order to create jobs and to reduce the rate of unemployment. That is the background to this issue.

Now it is not very easy to deal with because one of the major decisions when we took over as the government was to reduce the rate of inflation, to reduce the budget deficit and we have succeeded enormously in that regard. But to reduce the rate of inflation and the budget deficit meant that there should be a drastic cut in government expenditure and we took that decision. And we therefore inherited a situation whereby there was huge unemployment in this country, but we did not have and do not have the resources to address that unemployment.

We were able to go to the United Nations at a time when we owed more than $100 million in the form of arrears for membership, which the apartheid government did not pay when it was suspended. I had to go to the United Nations and to speak to Clinton, Boris Yeltsin, Jacques Chirac and others, Jiang Zemin and to ask them to write off this debt. Which they did.

Apart from what was owed to South African pension funds, there were loans from foreign banks and the International Monetary Fund.

The initial approach to dealing with the limited resources was to keep recurrent state expenditure to a sustainable level and thereby reinforce the RDP ministry and fund as a lever for reorienting the public service towards reconstruction and development, greater efficiency and more representative personnel.

The package of measures on these lines, as well as some privatisation of state assets,519 proved inadequate on their own, especially in attracting the investment needed. Despite government’s professed investor-friendly approach, the response from the private sector was disappointing. Mistrust persisted, with many business people locked in their belief that government had some stick up its sleeve which it would soon unleash upon the business community. The macroeconomic environment worsened, symbolically demonstrated by a massive depreciation of the Rand in early 1996. The post-apartheid dividend was nowhere in sight.

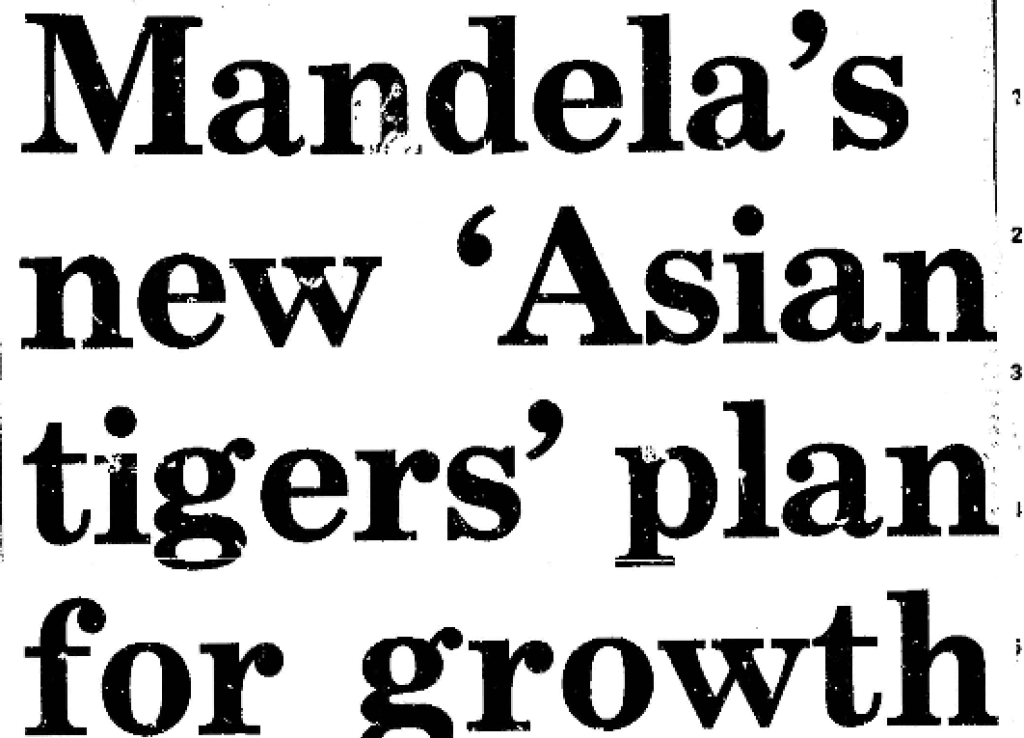

Ths In July 1995, following an ANC NEC assessment of government’s performance and its conclusion that implementation of programmes to extend access to basic services required greater focus of economic growth and investment,520 the Cabinet had established a special Ad Hoc Committee on Growth. It was chaired by President Mandela who told the Cabinet that it was ‘time to abandon its obsession with grand plans and make economic growth its top priority.’521 The committee included the ministers of finance, trade and industry, home affairs and the minister responsible for the RDP, as well as the two deputy presidents.522 Among other things it was overseeing the development of a National Growth and Development Strategy, an extended process due to complete during 1996.523 But well before it could be completed the volatile currency and insufficient investor confidence accelerated the elaboration of government’s macroeconomic stance in the form of the Growth, Employment and Redistribution Strategy (GEAR) , announced in June 1996.

The macroeconomic approach and how it related to poverty-eradication, involved Mandela in several roles: urging belt-tightening; courting investors; reopening doors into the world economy; engaging with the ANC’s Alliance partners; and deflecting demands from ministers faced with far-reaching commitments for a bigger slice of the available cake.

[Previously,] we refer to the view of Mr Meyer Kahn in which he expressed his disappointment that the increase in the police budget was only 3.7 per cent in monetary terms. There were many others, Cabinet Ministers included, who also complained about the cutting down of government expenditure.

I discussed the matter with Ms Gill Marcus, [who in 1999 became] Deputy Governor of the South African Reserve Bank , and she said that looking back over South Africa's development since 1994, there is no doubt that our country has achieved a number of remarkable successes. Economic policies had to address the consequences of decades of apartheid discrimination, while at the same time meet the stringent requirements of a rapidly changing world where globalisation was the dominant trend.

While South Africa was emerging from its long period of isolation, it emerged into a world that itself was undergoing rapid changes. The information age and new technologies, deregulation and liberalisation have all contributed to a world we hardly recognised. The challenge for us was not just to catch up with the rest of the world, but in fact to become part of a dynamic world in which international principles and standards, codes of conduct, best-practice rules, corporate governance and so on, set the parameters in which countries are judged as fit investment destinations or trading partners.

Integration into the international financial network was reinforced by South Africa's participation in various international forums, including bodies such as the World Trade Organisation, the International Monetary and Fiscal Committee, the Group of 20, the International Organisation of Securities Commissions (which promotes the development of efficient securities and future markets) and the Basel Committee Core Principles Liaison Group, concerned with sound banking supervision.

Government initiatives to integrate South Africa into the international financial markets focused on foreign investment and the liberalisation of capital flows.

The challenges facing a new democratic government in 1994 were daunting, and often underestimated. The phenomenal achievements are often not recognised because the magnitude of the problem is not fully realised. Unravelling the apartheid state infrastructure, including the bantustans, which were extensively underpinned by an intricate legal spider's web, was a feat in itself. But above all, the new government found economic chaos and coffers that were virtually empty.

While we recognise that many challenges still face us, not least among them tackling the high level of unemployment and attaining higher rates of growth, even our sharpest critics will acknowledge that an ANC government has put in place sound monetary and fiscal policies, and that the economy is better managed than ever before.

Prior to 1994, South Africa's economic growth rates were in decline. In the 1985–1990 period, South African economy's annual average growth rate was 1.0 per cent, falling to 0.2 per cent in the 1990–1994 period. In contrast, during the period 1994–2000, South Africa recorded an annual average economic growth rate of 3.0 per cent. Although not yet sufficient to absorb new entrants into the job market, significant structural reforms have been introduced, creating solid foundations that should help ensure future sustainable growth.

The government had to grapple with a large budget deficit. It had to come up with a new economic policy mix aimed at stabilising the macroeconomic fundamentals and build foreign investor confidence.

The opening up of the South African economy from 1994 (as measured by SA merchandise imports plus exports relative to GDP) has had many positive effects, not least among them the development of a significant export market. The importance of external demand for South Africa’s products is reflected in the five consecutive quarterly current account surpluses on the Balance of Payments that we have recorded as at June 2001.

The government deficit has been reduced to two per cent of GDP in 2000, markedly lower that the 7.2 per cent in [the] fiscal year 1992/3. This is far below the deficit level of most developed economies.

On the monetary policy front, the South African Reserve Bank has helped to improve the interest rate environment, another growth-positive factor from the very high levels of 25 per cent in the eighties to 13.75 per cent in June 2001. The low or normalised interest rate levels are conducive to stronger fixed capital investment.

The rate of inflation has come down significantly. From a level of 15.5 per cent in the period 1985–1990 to 12.5 per cent in the period 1990–1994, inflation has maintained an average of 7.3 per cent in the period 1994–2000. Recognising the importance of price stability, the government and the South African Reserve Bank introduced an inflation-targeting framework, with an initial target of between 3–6% [sic] average in 2002. Thus the prevailing inflation trend is downwards.

A critical issue that faces many countries in transition is collection of taxes, one of the key hallmarks of governance. South Africa’s young democracy faced an even greater challenge given that the African majority had resisted taxation (e.g. Bambatha poll tax rebellion), as they were not willing to fund their own enslavement. Therefore the task was not only to bring millions of new taxpayers into the net, but also to ensure everyone paid their fair share. Tax reform was an integral part of the overall fiscal strategy.

The success with regard to reorganising the entire tax system, including customs and cross-border management, has played a significant part in government being able to reduce its borrowing requirement, and hence also the budget deficit. It has enabled significant tax reform to take place ... Corporate income tax has been significantly reduced.

Despite cutting taxes, both personal and corporate, and virtually eliminating fiscal drag, the South African Revenue Services has consistently exceeded the stringent targets set for total revenue collection. This has been achieved by improved infrastructure, smarter methods of work, better systems and enforcement, as well as recognition by the taxpaying population that everyone has a responsibility to pay their fair share.

Foreign investor confidence has improved markedly as a result of the government's commitment to macro-economic discipline. In the year 2000 alone, the turnover in the bond market rose to a record R10.5 trillion and a record turnover in shares of R537 billion.

Debt service costs rose during the 1990s from 15 per cent to over 20 per cent of the budget in 1998/9. This steadily eroded the resources available for delivery of services; for instance, the amount spent on servicing debt was roughly equal to the amount spent on education, the greatest expenditure items on the budget. This trend has been reversed and it is expected that by 2002/3 debt service costs will fall to 4.4 per cent of GDP, releasing an additional R10bn to spend on services. By 2005, it is estimated that interest on debt will be reduced to 16.4 per cent of consolidated spending.

The macro-economic strategy followed since 1996 focused firmly on building foundations for sustainable long-term growth. This requires higher levels of savings (currently hovering around the 15.5 per cent of GDP ratio) and investment. Government dis-saving has significantly reduced, and it will not be long before the local government sector will make a positive contribution to the national saving effort.

The budget deficit has been lowered from 7.2 per cent of GDP in 1992/3 to 4.6 per cent of GDP in 1996/7 and to 2.0 per cent of GDP in 2000/01.

Behind this summary of the country’s macroeconomic environment lay many engagements with the country’s social actors on the policy which he explained and defended. Though not versed in economic theory, knowing the importance of economic policy and believing in the necessity of the approach adopted, he did so vigorously.

Belt-tightening’ meant doing more with less and when integration of the public service was followed by rationaliisation or down-sizing, it meant retrenchment was part of a package of measures Cabinet adopted in October 1994 as ‘a contribution to the transformation of the public sector to promote implementation of the RDP, growth and prosperity.’525 In this context a cut in the salary of the president and deputy presidents (20%) and ministers (10%) and the freezing of senior officials salaries (together with an increase in the minimum wage of public servants of R15,000), may have amounted to a small fraction of the budget, but was intended as an exemplary message that combined cost-cutting with narrowing the wage gap.

Mandela said the salary cuts would set an example of the fiscal discipline needed as South Africa dealt with apartheid legacy of social ills.

State ownership of economic assets was another point of contention. The Ready to Govern policy conference which had anticipated the challenge of macro-economic stabilisation, if not its scale, was also the setting for a sharp debate on an economic issue that remained a point of contention during the first democratic government namely, privatisation. As noted earlier, coming out of prison Mandela, against the advice of those he consulted, declared his support for nationalisation of key sectors of the economy, not in his first speech, when he called rather for ‘radical restructuring of the country’s political and economic systems’, but on various occasions in the following days and months. As global change had loosened ties on the mobility of capital and in the light of experience of nationalisation in other countries, ANC rethinking was reflected in its 1985 Policy Guidelines for the Future of South Africa. The constitutional guidelines developed in the late 1980s spoke of a mixed economy. As far back as the early 1980s an ANC delegation (led by then President Oliver Tambo) meeting with senior leaders of the Cuban Communist Party had been told much the same, As far back as the early 1980s an ANC delegation (led by then President Oliver Tambo) meeting with senior leaders of the Cuban Communist Party had been told much the same, that 'in a world that was becoming increasingly globalised, nationalisation was not realistic'.526 As a banned organisation the ANC had been denied the conditions for a policy conference to address the issue, and coming out of prison, Mandela defended the position as the existing policy.

The interactions of the ANC and Mandela with economic role-players in the following months reinforced the rethinking. Sometime between in December 1991 or January 1992, Mandela made a note ‘Need for revised economic policy - conference.’527 A visit to the World Economic Forum some weeks later, and not long before the ANC’s Ready to Govern policy conference, provided a catalyst, both as confirmation of this view and as opportunity to manage the shift. While at the World Economic Forum the premier of China asked the WEF chairperson to arrange a meeting with Mandela, at which he said that China’s experience suggested that nationalisation would be an error.528 The premier of Vietnam, also at the forum, conveyed a similar message. Mandela told members of his delegation to report on the matter to the ANC officials, and that it was necessary to ‘forget nationalisation and focus on the basic needs of our people’.529 If, he said, on another occasion, circumstances require a choice between nationalisation and investment, then investment would be the choice.530

The Ready to Govern conference formally registered the change in a formulation – suggested by Sisulu or Mandela (accounts differ) who were called into the commission on economic policy to resolve a debate that had gone on for hours. To avoid the deadlocking words ‘privatisation’ and ‘nationalisation’, it was agreed that public ownership was to be flexibly expanded or diminished according to ‘the balance of evidence in restructuring the public sector to carry out national goals.’

While the wording provided a way out of a polarised debate and suggested some guidelines on the issue, it defined a space for contestation of government policy in the years ahead.

When the democratic government made privatisation of some assets part of the restructuring of the public sector it became a point of contention within the ANC’s constituency. But a way forward was negotiated with organised labour.

'we must focus on the basic needs of our people'

We can only get investment and build our economy if investor confidence is maintained

The matter of restructuring of state assets is being thrashed out in the relevant structures; and great progress has been made in this regard. There is no disagreement in the Alliance that some of the assets should be privatised; that others should acquire strategic partners and that yet others should restructure their operations. And the detail is being, and should be, settled in negotiations on a case-by-case basis.531

Although debate about privatisation persisted, it had none of the intensity and heat of the debate that gathered pace when the macro-economic stabilisation measures were elaborated in the Growth, Employment and Redistribution (GEAR) policy. The debate on economic policy found some sort of resolution at the ANC’s 50th National Conference in December 1997, which agreed that:

The emphasis in the RDP on macroeconomic balance has been a consistent part of ANC policy and has been mentioned in every policy document since 1990. The strategy for Growth, Employment and Redistribution (GEAR) aims at creating the environment of macro-economic balances required for the realisation of the RDP. In this therefore, the GEAR does not seek to displace the RDP.532

But the matter continued to fester, souring relations amongst Alliance partners, as described in Chapter 17.

Related to this was the question of the social system that the ANC was pursuing. Mandela’s pragmatic approach to this issue was exemplified in an answer to a question after he gave a lecture in Singapore:

We are not concerned with labels, whether our system ifs capitalism or socialism. We are concerned with delivering services to the masses of our people who were denied all the basic rights of citizenship, who could not go to school, who could not acquire knowledge, skills and expertise. We have declared in our election manifesto that our aim is to better the lives of our people.533

Relations with business were not satisfactory either. Publicly Mandela commended corporate sector responses to his personal appeals to fund the building of schools and clinics, or for participation in projects like Business Against Crime and Rural Safety. But South African business was proving reluctant to invest in the country’s future. As this constraint became evident, it could no longer be assumed that business would be an enthusiastic partner in reconstruction and development.

Gear had been presented when announced as a national economic framework that was part of the Growth and Development Strategy other elements of which were the Reconstruction and Development Programme and the work of the Labour Market Commission. But in practice the threads of policy were not always coherent. And although one of Gear’s pillars was the need for better integration of government economic policy, it was itself more about the achievement of macro-economic balance than matters to do with industrial strategy and redistribution. Reserve Bank policy approaches informed by old thinking at critical moments had not helped matters either - during the Asian financial crisis in 1998, for instance, an ill-advised foray to defend the exchange rate using the Reserve Bank’s miniscule foreign currency and gold reserves had not only squandered these reserves, but also resulted in interest rates that had climbed back to the level of the 1980s.

One of the key proposals of the Labour Market Commission , whose work had received strong support from Mandela, and whose report was published a few days after the announcement of Gear, was for a social compact of government, business and labour. Although the National Economic Development and Labour Council (NEDLAC) had been launched the year before with great hopes that it would help forge that compact, an objective that also informed the Presidential Jobs Summit in 1998, the goal was, by the end of Mandela’s presidential years, achieved more in word than in deed.